Credit Hygiene 101 – Your Free Credit Report

Christopher Shank NMLS 2562885

As identified before, your credit plays a huge role in your future. Unfortunately, an uncomfortably small percentage of folks out there take more than a passing interest in their credit. Earlier, a young woman reached out to me, looking for a preapproval. She was beyond excited, as she found the house for her. All she needed was documentation from a loan officer saying that she was cleared for financing, and her realtor would submit her purchase offer.

No sweat- she got her application knocked out within fifteen minutes, and my ops team started working immediately, on track to meet our two-hour preapproval window. Credit report came back, and my heart sank. 532 median credit score, and seven accounts showing 90-day+ delinquencies.

I reached out to this young woman to share some bad news- she wasn’t going to be able to get that dream house until she got her finances in order. The woman was equal parts perplexed and devastated, largely because she had thought that her finances were in order. Long story short, she was the victim of identity theft; four years or so ago, someone opened up over a half dozen accounts in her name, tied her to about fifteen thousand dollars worth of debt, and then disappeared. She’s been connected with a credit repair specialist, who is right now appealing the charges and is confident that in one to two months time, her credit will be right as rain.

Unfortunately, I don’t have a lot of faith that this dream house she found will remain on the market during that time. The thing that hurts is that these fraudulent charges have been sitting on this woman’s credit for four years, but she had remained ignorant to this fact until she needed to leverage her credit.

Well, it’s time to take action- I don’t want something like this to happen again. To that end, I’m going to teach you how to take charge of your credit, and we’re going to start by actually looking at your credit report. Don’t worry- this process is actually free, so you’re free to follow along with your own report as we go!

Getting Your Free Credit Report

Congratulations! In addition to the rights to worship and arm yourselves, as an American citizen, you also have the right to one free credit report per year from Experian, TransUnion, and Equifax, courtesy of the Fair and Accurate Credit Transactions Act of 2003! If that’s not a Texas-sized hunk of freedom for you, I really don’t know what more could float your boat.

Now, for the love of God, please don’t simply Google “free credit report” and click on the first link. Instead, to access the free credit reports to which you are entitled, you need to visit https://www.annualcreditreport.com, as it is the only government-operated credit report website. Reports pulled through annualcreditreport.com will not negatively impact your credit, nor will you be charged for the information they provide (things that cannot be guaranteed by other report providers).

Bit of a disclaimer- the reports pulled through annualcreditreport.com will not give you your credit scores. If you’re looking for those, I would recommend creating a user account with each credit reporting bureau and pulling your scores directly using their platforms.

Now, once you arrive on the homepage, you’re going to click the big button in the center that says “Request your free credit reports”. From there, it’s going to ask you a bunch of personal information, to ensure that the reports that are pulled actually belong to you. One of the most important questions you’ll be asked during this phase is whether you want to pull a report from each bureau at once, or if you’d like to pull only one for the time being. Personally, I recommend only pulling one, and here’s why. Each calendar year, you’re entitled to one report per bureau. A lot can happen in one year, so to maximize coverage, I’d space your credit reports out to every four months or so. For example, if we pull Experian today, in December we can pull a report from TransUnion, and come April of next year, we can do the same for Equifax.

For the purposes of this article, I pulled a report from Experian (which means that if you want to follow along with me, you should at least pull the same report). Once you’ve input the required information and verified yourself, the website should automatically direct you to a report from the credit bureau specified. Immediately save a copy of your report to your desktop. For security purposes, these reports time out quickly, and once that happens, your report is lost.

Okay, ready? It’s time for us to dive in.

Reading Your Free Credit Report

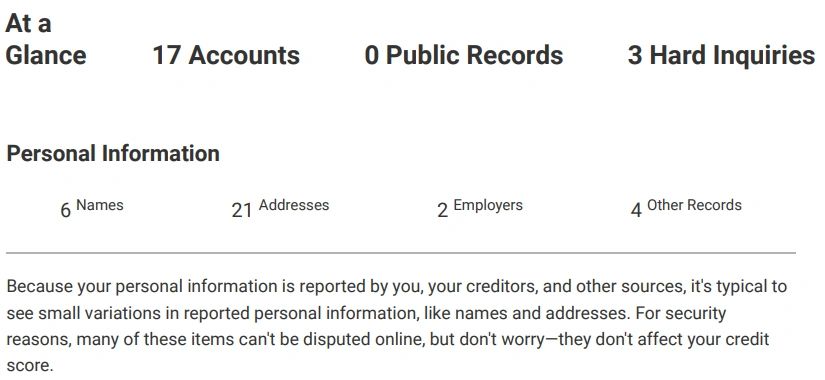

Right at the top of your report, you’ve got a basic summary of the information you’ve got in this report.

“Accounts” refers to the number of accounts that are currently reporting information on you. These are either accounts created in your name, or accounts that you have been named as an authorized user. Every account listed here counts either for, or against, your credit.

“Public Records” are items where your financial foundation has interacted with our legal system. If you’ve had a bankruptcy, it’ll show up here- same for tax liens and legal judgements against you.

“Hard Inquiries” are hard credit pulls against your credit. These typically indicate some finance-related activity that you initiated, such as an auto loan, application for a new credit card, or mortgage activity.

Under personal information, this lists the various names, addresses, employers, and other items that have been associated with this report. The first thing you should do when assessing your credit report is to look through these lists and identify things that should not be there. For me, my “names” log includes different variations as to how I spell my name- “Chris Shank” and “Christopher Shank” being the two most common.

As a Marine, I lived in quite a few places, so it’s not surprising that my address list is rather lengthy. What did surprise me is that under “Other Records”, I found my ex’s phone number. Interestingly enough, when we financed a vehicle jointly in 2017, her phone number was one of the items reported to Experian for my credit report. Items unfamiliar to you can be indicators of identity theft, so keep your eyes peeled as you review these reports; now is not the time to slack off.

Credit Accounts

Once you get past the section establishing your financial identity, your report will list every account that you currently have reporting on or against your credit.

According to this sample data, this is a credit account with Jared’s Galleria of Jewelry that was opened in July of 2012. The account had a maximum credit limit of $7,600, but the most I ever put on it was $4,858. Per the payment history, I put a charge on this account in the summer of 2017 and paid my balance off in May of 2019, after which the account was closed. Now, for the sake of comparison, check out the following screenshot:

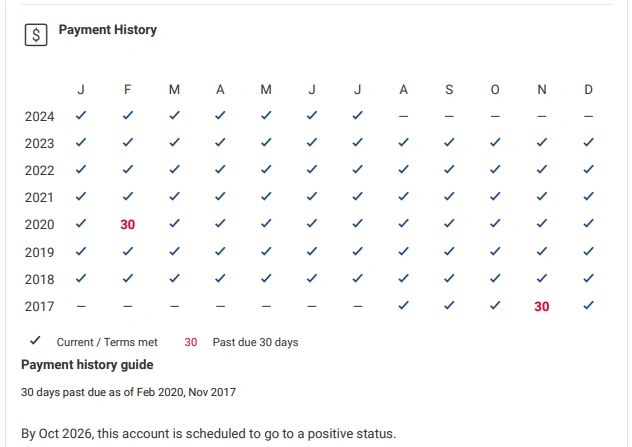

This is an Amazon credit card that I opened in 2017 that I continue to use to this day. Your eyes should immediately catch on the RED “30”s in my payment history. These indicate months where my credit company reported that I missed my regular payment for at least 30 days. Had I missed my payment again, say in March of 2020, instead of a checkbox, there would be a red “60” to indicate 60+ days of missed payments.

Missed payments are kicks to your credit score’s kidneys, because they identify times where you were unable to manage your finances and cost your creditor money. Patterns of missed payments (repeated red marks) in your recent history can even turn off lenders entirely, but even one-off missed payments can hurt. Seriously- check this out.

According to Experian, because of my two missed payments since 2017, this particular account is actually negatively affecting my credit, and will continue to do so until October of 2026!

Hard Credit Inquiries

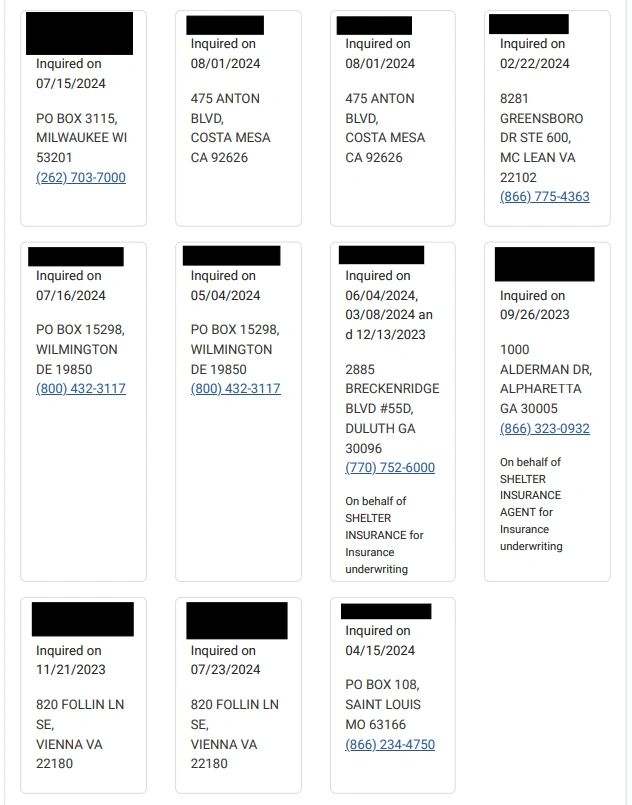

Once you make it past your accounts, your credit report is records all the hard and soft credit inquiries that have been logged against you. Now, as I mentioned earlier, hard credit pulls are usually run because you are looking for credit to purchase something, such as a new car or home. Hard credit pulls can also be initiated by other organizations as a result of your financial mismanagement, such as when your debts are transferred over to a collections company.

Hard credit pulls are readily visible to everyone who looks into your credit, and oftentimes serve as warnings to lenders who are considering investing with you. Even more, multiple hard credit pulls in a short amount of time have a chance of reducing your credit scores for up to a year.

From my report, I have three hard pulls on record; one from when I applied for a Kohls credit card back in 2023, and two from my homebuying process back in 2022.

Most times, companies are required to get your consent prior to running a hard credit pull. This means that if you see an entry here that you don’t recognize, you might want to reach out to that organization to find out why they felt it necessary to tap your credit.

Soft Credit Inquiries

Sometimes, a third party needs to access your credit report, but doesn’t want that check to affect you or be announced to the world at large. In situations like this, a soft pull is used, and that pull does not affect your credit score.

Now, check this out-

These are all the soft credit pulls Experian has reported on me in the last year. Factoring in the three pulls recorded under one entry, my credit has experienced 13 soft credit pulls since this time last year.

Soft pulls are usually run by creditors with which you already have a relationship with. In this list, I identified the company who currently services my mortgage, my bank, and the companies who oversee my two credit cards. The reason behind these checks is simple- my creditors want remain aware as to the state of my finances. After all, if my mortgage company were to check in on me and see that my finances had turned into a raging dumpster fire, they would be able to better prepare to foreclose upon me, should I fail in my obligation to pay my mortgage.

Finding Evil

Thankfully, upon reviewing my credit report, I did not find any entries that were out of place or unfamiliar to me. Should that not be the case for you, I encourage you to immediately reach out to that credit bureau and launch an inquiry.

Identity theft is a real threat, and most adults will, at least once in their lives, have their information used to secure credit without their permission. Thankfully, there are laws out there to protect you, but in many instances, the damage can take a while to repair.

Conclusion

If you’ve been following along with me, chances are this whole process took less than half an hour, beginning to end. There are 525,600 minutes in a year; I do not believe that spending ninety of those to ensure proper financial hygiene is too terrible an ask.

If you want some motivation, remember the woman I wrote about at the beginning of this article. Not only is she likely going to lose out on the opportunity to purchase the house of her dreams, but her credit has been negatively impacted for the past four years.

During that time, this woman’s poor credit has likely cost her thousands of dollars that she didn’t have to pay. Think of it- if she purchased a car, or got herself a credit card or personal loan, she likely will have been given a higher interest because of her high risk status. Her insurance rates will likely have been higher than they should have, as well, because insurance companies often use credit histories to determine how much their clients pay for their policies. Some employers (oftentimes in the financial sector) also use credit information to judge the financial responsibility of prospective hires (I had to undergo credit screening to become an insurance agent, and then again to become a loan officer).

Thirty minutes every four months to ensure that I haven’t become a victim of fraud? All things told, that doesn’t seem like much of an ask.

Now, if you have any questions, comments, concerns, or would like to speak to a financial professional to dig into your own report, feel free to reach out! Personally, I’m a fan of fixing financial problems by hand, but I also have a few credit repair specialists that I call upon for especially dire matters- all you have to do is ask!