All About Refinancing (and When You Should Do It)

Christopher Shank NMLS 2562885

Well folks, refi season is upon us! Believe it or not, I’m a rather uncommon loan officer in the fact that I’m usually not the biggest advocate of refinancing, at least not unless said refinance can be proven to be in someone’s best interest. In today’s article, I’m going to break down how a refinance works, along with the main reasons why someone might want to refinance, and the ways to quantitatively verify whether or not that refinance actually is a sound idea.

Refinancing In A Nutshell

Okay- now, before we begin, we need to actually define the term “refinance”. A refinance is a process whereby someone with a preexisting loan on a piece of property transfers their credit obligation to another company. Despite advertising to the contrary, refinances are not simple processes. Like the initial financing process that allowed you to take a loan on the property in the first place, the process of refinancing involves a new lender putting forth dozens of hours worth of labor to ensure that the decision to transfer your debt to them is a wise investment in the first place.

Just as these services cost money in the initial financing of your property, they have a cost during the refinancing process as well. For the sake of transparency, here are the four most common costs associated with the refinancing of property:

- Processing and Underwriting Fees: Also known as origination fees- as the one requesting the professional services of several folks to work on your loan, it only makes sense that you pay their service fees.

- Insurance: As a rule of thumb, whenever you finance a property, you need to ensure that property is insured to protect your lender’s financial interests. When it comes to real estate, that means that you’re usually obligated to purchase a year’s worth of property insurance up front. Fun fact: if your property is already insured, you’re still going to need to provide a year’s worth of insurance up front. Most of the time, this translates to you paying for another year’s worth of coverage at closing, which will be partly refunded to you when your previous loan servicer refunds you your old escrow account.

- Taxes: Just like with insurance, rarely will your escrow account transfer with a refinance. Because of that, you’re likely to have to prepay your escrow account at closing and be reimbursed by your former servicer sometime in the next few weeks.

- Appraisal: Some loan products and lenders don’t require appraisals for refinances, but others do. If your new lender requires your property be assessed prior to closing, the costs of this action will be passed over to you.

If you paid attention to your initial loan process, these above costs should be very similar- the above items comprise your “closing costs”, and are common in most loan transactions, be they initial finance or refinance.

The goal of any refinance is the establishment of a new financial obligation, structured similarly to the one in which you initially financed your property, whereby you (and your co-borrower, if applicable) agree to repay your new finance company X amount of money over Y number of years, at an interest rate of Z.

So- at the end of the day, you’re essentially paying a lot of money to replace one creditor with another. Why go through the hassle?

Benefits of Refinancing

There are as many unique reasons to refinance as there are folks out there looking to refinance. That said, most of these reasons are similar enough that they can be grouped into a handful of categories:

- Lower Interest Rate: This one’s a no brainer. If you purchased a house at a 7.99% interest rate, you’d likely jump at an opportunity to drop that down into the 5’s. Check this- a $250,000 house purchased with a 30 year fixed rate loan at 7.99% interest will require paying over $409,000 in interest by the end of the loan. Conversely, that same home and loan at a 5.99% interest will require only $289,000 in interest over the same length of time. Crazy what only a few percent points does, huh?

- Lower Monthly Payment: I don’t think I’ve heard a refinance advertisement that didn’t include the phrase “lower your monthly payment”. This is achieved one of two ways. You can either lower your interest rate (as above), or you could extend the length of your loan (more on this point of contention later).

- Escape a particular loan servicer: This has actually become more common the last couple of years. As identified in my last article, about two in three home loans are sold on the secondary market. Not going to drop any names here, but I’m certain you know someone who has a horror story about their current loan servicer, whether it be poor customer service, insurance hiccups, or inappropriate fees or charges. While you can’t control who your loan is sold to on the secondary market, you can control who finances (or refinances) your loan. Because of this, I’ve seen more than a few folks refinance simply to put their loan in the hands of a lender who will retain their loan for the long term.

- Tap into Equity: most of the cash-out refinances that I’ve worked with are initiated by real estate investors. Think of it this way. You purchased a house in 2019 to use as a rental. During the past five years, this house has appreciated in value by over $150,000. By way of a cash-out refinance, you can liquidate this equity and use that money to cover the down payment of two new investment properties (both of which will probably experience their own property value increases in the next few years).

The Not-so Benefits of Refinancing (Time for Math)

*The links referenced in these examples will direct you to a calculator and fee schedule so you can follow along, should you prefer to do so*

Full transparency time- loan officers make money when you refinance. As a correspondence lender, my commission is paid by the lender, rather than the borrower. Even so, I’m rather abnormal in this field in the fact that I don’t push for refinances very often because in most cases, the math just doesn’t work out in favor of my clients.

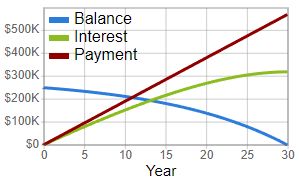

Let me break this down in an example. Check this out- $250,000 purchase, 30 year fixed rate loan at 6.5%. Mapped to a graph, your payments will look like this:

Look between years 0 and 5- see how the red and green lines are practically on top of one another? For the first several years of your loan, the majority of each month’s payment goes toward paying down your interest, rather than the principal of your loan.

Seriously- in our example, our monthly mortgage payment (factoring out taxes and insurance) is $1580.17, which puts our yearly payment at $18,962. During our first year, we will have contributed $16,168 toward the interest on this loan, while only $2794 has gone toward the principal that we owe. Year two is a little more in our favor- by year’s end, we will have contributed $15,981 toward interest, while our contribution toward principal will have increased by just shy of $200 ($2,981).

During the first five years of this mortgage, we will have paid $78,839 toward interest, while reducing the principal of our loan by only $15,971.

This pattern continues until we hit our break even point at year 20, where in that year, we will have contributed $9,386 toward interest and $9,576 toward the principal of our loan. Even then, by that point, we will have paid $268,405 toward interest on our $250,000 purchase, while reducing our principal by only $110,837.

Interest is a sunk cost – Payments you’ve made toward interest have no bearing on any refinance activity you may do.

Let’s move on to part two of this example- the refinance.

Say, for simplicity’s sake, we get approached by a loan officer who wants to refinance us at 5.99 for 30 years fixed, and this refinance will cost $6,000 in closing expenses. Don’t worry though, those closing expenses can be financed (which means you don’t have to pay for them immediately- they can be added to the amount of your loan) as long as the total loan doesn’t cost more than the value of the house (for the sake of this example, that value will remain $250,000, regardless of appreciation or other market forces). Dropping down half a percent will reduce our monthly payments from $1580 to $1497- good deal, right?

Well, let’s look at the math. We purchased this house for $250,000, which means that if we don’t want to pay out of pocket for our refinance ($6,000), our principal needs to be $244,000 or lower. Based off of our pay schedule, we’ll hit that right around the start of year three of our initial loan. By this point, we will have already contributed over $32,000 toward interest, which we’re not going to get back. Is it still worth it?

Based on the fee schedule, a $250,000 30 year fixed rate loan at 6.5% has a total principal and interest cost of $568,861, where the cost of the same loan at 5.99% is $539,016 – $29,845 less. However, despite the fact that this new loan will cost less in the long term and will cost $83 less per month, it will actually cost us more money in the grand scheme of things, once you factor in the $32,000 that has already been sunk into interest.

I hope you see now why this subject means a lot to me- even though everything about that refinance offer seemed like it was a good deal, taken wholistically against our preexisting financial situation, the numbers proved how such a refinance could actually cost us money in the end. Now, this isn’t to say that refinancing isn’t a good idea; I certainly could benefit from freeing up eighty bucks per month. THAT determination, however, is entirely up to the borrower.

How to Make the Numbers Work For You

If you haven’t figured this out yet, I’m kind of a nerd when it comes to finance. That said, there are ways that I like to use math to actually find a viable solution. Let’s go back to the earlier examples, but instead of accepting that loan officer’s refinance offer of $250,000 for 30 years at 5.99%, let’s counter with a 28 year term.

Compared to our first loan, our monthly payment will only drop down $44. However, the difference comes into play at the total principal and interest cost of this new loan $516,174. Even factoring in the $32,000 you already sunk in interest for the first two years of your first loan, at the end of the day, refinancing for 28 years at 5.99% will save you around $20,000 in interest over the life of your loan!

If you want to get extra fancy with it, you can take that $44 you freed up from refinancing and contribute it directly toward principal each month. If you do things this way, you’ll be able to pay off your loan one year and ten months earlier than anticipated, saving over $20,000 extra in interest by the end of the loan.

$40,000 in savings and a loan paid off almost two years early- that is how you refinance.

The Bright Side of Refinancing

A few years ago, I bought stocks in AMC at the advice of an investor friend of mine. I didn’t take the time to learn the stock market, which ultimately burnt me. Oh, I sure had a good time watching my $2,000 investment double and then double again, but because I didn’t know how to run the math on the back end (or how to utilize E-Trade’s safety features), I ended out losing half my investment by the time the AMC stock deflated and I finally sold.

I hold refinancing with the same regard. As proven mathematically in the section above, there is a way to maneuver a refinance to provide a clear financial benefit to folks. By the same token, the section before the last demonstrated how a similar refinance product, even though it looked like a better option, could actually cost more in the long run.

If you are considering a refinance, I highly encourage you to do the math for yourself to determine if the numbers really do add up. I would then bring in a trusted Mortgage Advocate to go over those numbers to ensure that things legitimately make sense for you.

As an added benefit, your trusted Advocate may have access to incentives to further sweeten the deal. For example, until September, I have access to a lender who is offering a 1.25% lender-paid compensation on all VA and FHA refinances. This can be used to further buy down the interest rate of your refinance, or even to pay your closing costs! If you’re curious about what offers are available, or simply want to run some math, feel free to reach out!