What the Fed – Market Forces and Interest Rates

Christopher Shank NMLS 2562885

We’ve covered before how there are things you have control over that dictate the interest rates you get charged for your loans. Now, it’s time for us to delve into the things that you really don’t have control over because only by getting a full understanding of the big picture, can you truly feel confident in your ability to make educated financial decisions.

Now, before we start talking about why your interest rate was a 8.1% when your neighbor purchased their house two years ago at 2.9%, we need to cover a few pieces of background information.

Supply and Demand

A few years ago, one of my favorite television shows, Rick and Morty, sparked a craze when one of the characters mentioned McDonald’s szechuan sauce. The sauce was first released in 1998 as a promotion for the Disney movie, Mulan, and was discontinued shortly thereafter. Turns out, nostalgia is one heck of a feeling, because shortly after that particular episode of Rick and Morty aired, McDonalds announced that it was going to do a limited release of their szechuan sauce to capitalize on the publicity.

Folks- things got crazy (Seriously- check out these hyperlinks for some historical madness). As my economics teacher once drilled into my head, when there is a limited supply of something and a large demand for that thing, the price that a seller can charge for that particular item can rise with a reasonable expectation of someone buying at that price. The inverse is true; if you have a lot of a particular thing, but few people are interested in buying it, the price of each individual item is likely to drop to incentivize more people to make a purchase.

In our economy, supply and demand dictate a lot more of our daily lives than you might initially believe. The daily special at your favorite restaurant is likely often driven by a relative overabundance of a particular ingredient back in the kitchen that needs to be consumed before it goes bad. The price of new vehicles often includes a sizable markup compared to the previous year’s model (compared to the factual differences between vehicles) simply because there haven’t been as many new vehicles manufactured to date. Heck, even private school for your children is dictated by the laws of supply and demand; a more exclusive class size warrants a higher tuition.

Inflation

Put simply, inflation happens when the price of goods and services rise, reducing the buying power of a fixed amount of currency. Let’s use eggs for this example. In 2008, the price of a dozen Grade A eggs was $.91. This past June, however, the price for the same quantity and quality of eggs was $2.71. By the same token, the median yearly income in 2008 was $32,390, whereby the same organization has determined that the median yearly income in 2024 is $59,228. Together, this means that while the average price of goods such as eggs has increased by 197% over the last sixteen years, the average income during that same time has only increased 82%.

Inflation usually occurs in the wake technological and cultural shifts, and is a natural process. Think of it like this. When televisions were first introduced, the most “affordable” model on the market was valued at $445, which is the equivalent of around $10,000 in 2024. There was a large demand for these new technologies, but not everyone could afford to drop that much money on such a device. To compensate, people started charging more for their goods and services, with the idea of saving up a little more money with which to contribute to their upcoming purchase. At the same time, the technology behind manufacturing televisions improved, reducing the expense to make each unit, the savings of which were ultimately passed to the consumer. Eventually, televisions became much more affordable, but the market-wide increase in the cost of goods and services was there to stay.

In 2020, the Covid-19 pandemic saw a lot of economic upheaval. Manufactories of goods across the globe were shut down for fear of infecting the workforce. As a result, the cost of basic processed materials, such as lumber, steel, and electronic components, increased, as dwindling stockpiles encouraged price escalations. Even after the forced industry closures of the pandemic, global shortfalls of items from automobile parts to computer chips inflated the price of goods across the spectrum.

A fair amount of inflation is natural, but too much inflation can be a very bad thing. In 1945 Hungary, the ravages of World War II caused supply chains to stretch and snap. Supply and demand was so out of alignment, for almost one year, the price of goods doubled every day. This is why organizations like the Fed, or Federal Reserve, are so important; they regulate the economy and use tools to encourage or discourage economic growth to ensure that the inflation we do experience is on par with a healthy free market.

Mortgages and the Secondary Market

A mortgage is a fantastic financial opportunity for all parties. The buyer gets the benefit of having a piece of real estate that will likely appreciate in value over time. Additionally, instead of paying someone else’s mortgage through rent, part of that buyer’s monthly mortgage payments go toward the principal of their loan, called equity.

On the flip side, the financial backer behind that mortgage benefits from the interest collected from borrower. On your average 30 year fixed rate loan, the investor stands to see over a 100% return on their investment. Seriously- on a $250,000 home loan at 6% APR 30 year fixed-rate loan, the borrower will have paid almost $540,000 when all is said and done.

Let’s run with a hypothetical. Say you run a company, ABC Finance. At ABC, you have $100,000,000 with which to finance home loans. If your average loan is $250,000, you can finance 400 homes by the time your finances are tapped out. Now, from 6% interest alone, you’re going to make around $500,000 each month, but out of that, you’ve got to pay your employees, the rent or mortgage on your building, utilities, insurance, and all the other expenses that come from running a business. At the end of the day, you might be able to float by, but you definitely won’t be capitalizing on the $13,000,000,000,000 (that’s 13 trillion dollars) industry that is mortgage lending.

Now, on each mortgage, you stand to make around $290,000 by the end of 30 years, but that’ll tie up your investing capital for that same length of time. What if, instead, there was someone out there who was willing to buy that mortgage from you, tie up their investment capital for all that time, and give you a sizable chunk of change for your efforts?

This, folks, is the secondary market, and almost two of every three loans that are originated are sold to investors on the secondary market. This is why, if you purchased a home loan through United Wholesale or Cross-country Mortgage, you likely received documentation in the mail a few months later stating that your mortgage was now being serviced by PennyMac, US Bank, or Mr. Cooper. By selling those loans to the secondary market, the primary lenders can originate loans for many more clients in a given year, which keeps the economy well on track.

Economic Regulation

Wait- what’s this about the economy? Ready to have your mind blown? Remember when I said that $13 trillion US dollars were tied up in mortgages? According to this source, as of Q2 2024, the cumulative US household debt is now around $17.8 trillion dollars. Yes folks, almost three quarters of US personal debt is tied up in mortgages.

This is a big deal, and if you really boil things down, a lot of US domestic economic policy is tied directly into the mortgage industry. This means that a lot of US economic regulation is aimed to directly, or indirectly, heat or cool the housing market.

Let’s look at things this way. Say I hold a home-buying convention that is attended by one million people who do not own homes. Say I give one heck of a speech, and every one of those people goes out and buys a home. If we’re running with the $250,000 house example from earlier (which, admittedly, is a bit low), this means that those million people just contributed $250,000,000,000 (that’s 250 billion dollars) to our national consumer debt! For kicks and giggles, let’s take a look at some of the other consequences from this course of actions:

-If we’re going on an average of 7% moving expenses (realtor commissions, moving companies, etc.), we just injected 17.5 billion dollars into the economy.

-The price of building materials is sure to rise, as per Redfin.com, about one and three houses sold are new construction. We all remember how the cost of lumber skyrocketed during Covid, so picture that happening again.

-Due to a dramatic decrease in homes available on the market, supply and demand will likely increase home prices and decrease home purchases in subsequent months. This will hit banks, mortgage companies, and other financial lenders, who may not have anticipated such a decrease in business.

-Price increases in select economic sectors will inevitably create ripple effects as inflation spreads rampant through the economy.

Safe to say, unchecked economic activity can get… kind of dangerous. To prevent these types of things from happening, our economy is watched over by the Federal Reserve.

The Fed and the FFR

One of the most impactful tools the Fed has at its disposal is the ability to set the FFR, otherwise known as the Federal Funds Rate. The FFR is the rate at which banks borrow and lend their excess reserves to one another on an overnight basis. By law, financial institutions backed by the Federal Reserve must maintain a reserve equal to a certain percentage of funds in their accounts. Any money past this amount can be invested as the financial institution sees fit.

By increasing the FFR, it will be more costly for financial institutions to borrow money with which to invest elsewhere. Fewer banks making fewer investments has a trickle down effect that usually slows the economy, which can cool things down, should inflation start getting out of control.

On the flip side, should the FFR decrease, banks will find it easier with which to borrow money that they can reinvest into more profitable ventures. This injects more money into the economy, which usually stimulates economic growth.

What does all this mean for 2024?

Colleen, this one’s for you!

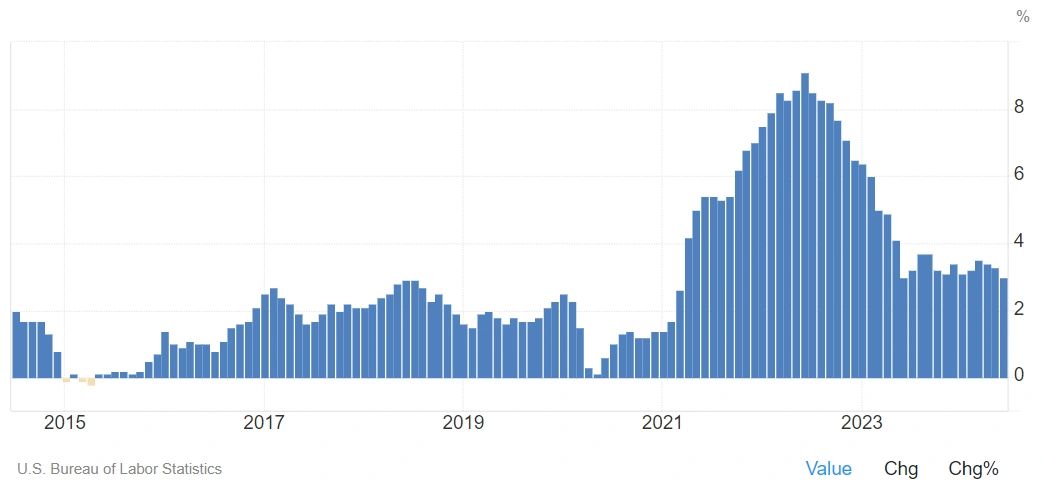

Okay, since the Pandemic, the United States has experienced a fair bit of inflation, illustrated by this helpful graphic from TradingEconomics.com.

As you can see, inflation took a hit during the first few months of 2020, when there was a lot of uncertainty related to the pandemic. Immediately after that, major economic and industrial sectors either shut down voluntarily, or were shut down on government orders. Once they reopened, manufacturers found themselves inundated with back orders that were not fulfilled while production was shut down, compounded by the fact that a notable numbers of employees refused to return to work.

Supply and demand being what they are, things simply became more expensive. Reduced fuel and auto part production caused a rise in shipping fees, which were passed along to the consumer in a general rise in the cost of commercial goods.

That was 2021 through 2023. As you can see on the chart, 2024’s rate of inflation is now reasonably close to what we experienced between 2017 and 2020 (at least compared to what it has been). This is good.

There was some speculation that the Fed would drop the FFR in June of 2024, which would, in turn, lead to a drop in interest rates. Unfortunately, as you can see by the below chart, the FFR did not decrease this past June, but has been sitting level since August of 2023.

There has been speculation that the next time the Fed convenes (17-18 September), they’ll reduce the FFR both to add some life to a slow homebuying season, and in recognition of more moderate inflation rates. Whether this happens, though, is anyone’s guess.

What’s This All Mean For Me?

Per the Motley Fool, the median house price in the United States in Q2 of 2024 was just over $400,000. Based on the numbers I gave earlier, if you purchased an “average” home earlier this year, you’re responsible for 0.00000002% of the national debt. This means that if our national debt was a pizza a thousand feet across, your portion would be about the size of an average piece of pepperoni.

In the grand scheme of things, your contribution and participation in this country’s economy is negligible. This means that rather put all your effort and worry into things like the Fed propensity to drop rates, you should instead focus on the things that you can control, like your financial foundation.

More than that, I encourage you to find comfort in the fact that since our economy is literally driven by the housing industry, powers far stronger than you are working day and night to ensure that said industry is always performing at an optimal level.

Beyond that, there are over 4,400 different lenders in this country who are in the business of making money. If people stop buying houses all of a sudden, their companies would quickly flounder (which, in turn, would lead to that whole economic collapse thing that everyone frets about). To work around this, lenders are regularly coming up with new and exciting incentives to encourage people to buy homes.

For example, this month, one of my favorite lenders is offering to comp 1.25% of the value of a refinance as a lender credit. This can be used to buy your rate down far below what you could usually hope to achieve in today’s market, or to cover the fees and costs associated with a refinance. This particular deal was created to offset the risks of an unfavorable September Fed decision, but whatever comes next month, I’m certain there will be new and exciting products out there to help you afford your dream home.

Personally, while I’m not holding my breath over the chance of us seeing rates in the 3%’s again anytime soon, current interest rates are very affordable, especially where they were this time last year. That, plus the fact that the housing inventory is a lot higher than where it should be, makes this an ideal time to look at buying a home or expanding your empire.

Regardless, if you have any questions or concerns, please feel free to reach out to your handy dandy trusted Mortgage Advocate– he’s kind of a nerd for these things and would like nothing more than to talk personal finance with you.